35+ Cost of 30 year mortgage calculator

On Thursday September 01 2022 the current average rate for a 30-year fixed mortgage is 595 rising 3 basis points over the last seven days. Assuming you have a 20 down payment 80000 your total mortgage on a 400000 home would be 320000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1437 monthly payment.

Pin By Ruby On My Stuff Messages Besties Timeline

News World Report to find the original MSRP range of each car for that given year and then took the average of the cars range values.

. The cost ranges anywhere from 03 to 12 of the amount borrowed. This credit is figured like last years economic impact payment EIP 3 except eligibility and the amount of the credit are based on your tax year 2021 information. Use our Alberta mortgage calculator to determine your monthly mortgage payment for your home purchase in Alberta.

Line 30 and the Recovery Rebate Credit Worksheet to figure your credit amount. 30 45 6000 36 54 27 41 7000 33. 35 years times 12 months per year produces a persons Average Indexed Monthly Earnings or AIME.

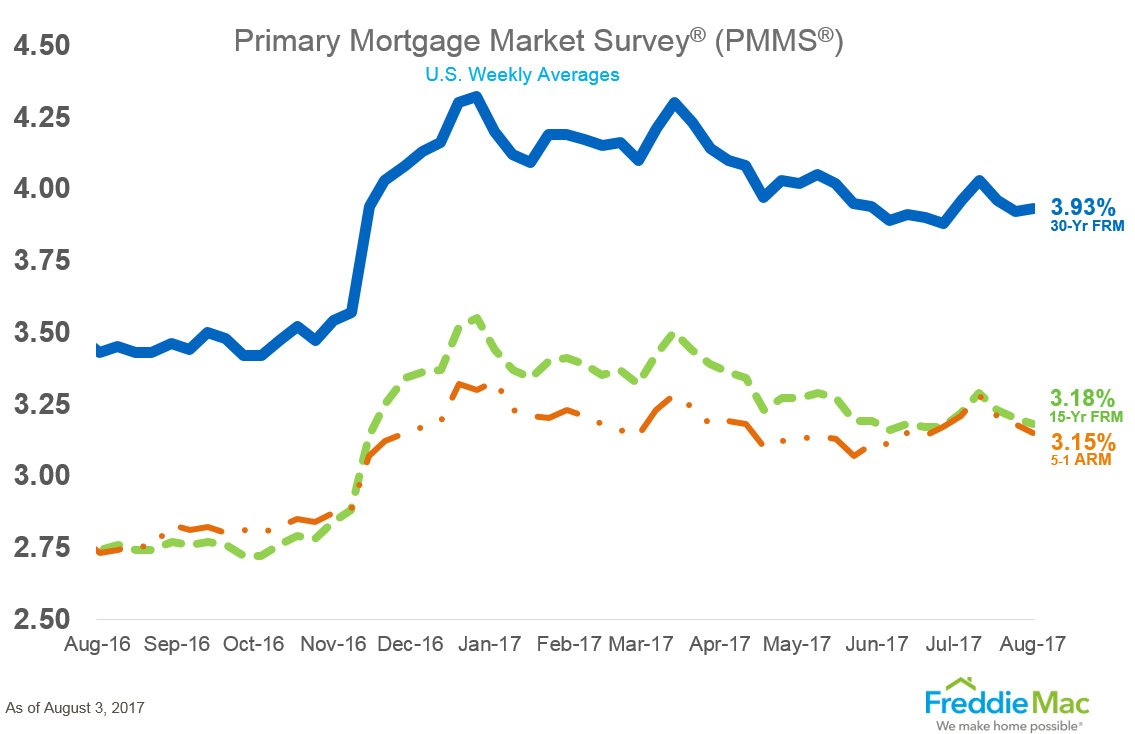

In 2016 the average mortgage term in Sweeden was reported to be 140 years before regulators set a cap at 105 years. The PMI charge is based upon the size of the loan the size of the down-payment. Todays national mortgage rate trends.

The average interest rate for the most popular 30-year fixed mortgage is 55 according to data from SP Global. This would mean that if you borrowed 200000 to buy a home the annual PMI cost might range between 600 and 2400. Cost of living comparison calculator.

65897 66. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. Need a sample amortization schedule for a 30-year fixed mortgage.

1317957 132 rounded to the nearest whole number 132 months to reach your break-even point on your investment. How much house can you afford. The AIME is then used to calculate the Primary Insurance Amount or PIA.

Free mortgage calculator to find monthly payment total home ownership cost and amortization schedule with options for taxes PMI HOA and early payoff. A Monthly Chartbook released in June 2020. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms.

The full owner of the mortgaged property until the last monthly payment is made. In the example each point would cost 2000 because 1 of 200000 is equal to 2000. The limit for equity debt used in origination or home improvement is 100000.

In the US the most common mortgage loan is the conventional 30-year fixed-interest loan which. Current housing market trends. This calculator figures monthly mortgage payments based on the principal borrowed the length of the loan and the annual interest rate.

The home price is the cost of the property that the homebuyer decides to purchase. Below is a graph that displays the approximate values of competitive 5-year fixed mortgage rates since 2006. Interest paid on the mortgages of up to two homes with it being limited to your first 1 million of debt.

Not all interest paid toward a mortgage is tax deductable. Cost of living comparison calculator. To estimate your break-even point more easily you can use the above calculator.

It is the second most purchased type of mortgage product next to 30-year fixed-rate loans. For this reason when they can afford it homeowners refinance their 30-year mortgage into a 15-year loan when index rates are lower. Assuming you have a 20 down payment 50000 your total mortgage on a 250000 home would be 200000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 898 monthly payment.

Generally the amount of income you can receive before you must file a return has. Homes purchased after Dec. A 75 year-on-year increase in first-time buyers taking out 35-year mortgages during the stamp duty holiday in order to combat rising house prices.

For the years 2015 through 2020 GOBankingRates used both Kelley Blue Book and US. In 2016 and 2017 many younger borrowers across the UK have moved away from using their once-standard 25-year mortgage toward 30 35 even 40-year loan options. This data is based on Housing Finance at a Glance.

As of January 10 2021 the average mortgage rate for a 30-year FRM is 265 APR while the average interest rate for a 15-year FRM is 216 APR. With the mortgage calculator you can easily find out your monthly payment by inputting information such as the home price down payment interest rate and potential HOA fees. The cost of monthly mortgage repayments on a.

Cost of living comparison calculator. Use our calculator above. Interest on up to 750000 of first mortgage debt is tax deductible.

The total cost of the Social Security program for the year 2019 was 1059 trillion or about 5 percent of US. A 30-year mortgage comes with a locked interest rate for the entire life of the loan. McBride sees the 30-year fixed-rate mortgage peaking in 2022 at 375 percent and finishing the year at 35.

Deduction for medical expenses that exceed 75 of AGI. If youve taken a 30-year FRM you can refinance to a 15-year term after a couple of years. As for 30-year fixed-rate mortgages Urban Institute reported that it.

Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. 5-year Fixed Mortgage Rates.

This allows you to secure a lower rate and pay your mortgage earlier. Because the rate stays the same expect your monthly payments to be fixed for 30 years. 25 years for mortgages with down payments under 20 or 35 years for mortgages with.

GOBankingRates then used the Bureau of Labor Statistics inflation calculator to find the February 2019 dollar value of each. The above calculations presume a 20 down payment on a 250000 home a closing cost of 3700 which is rolled into the loan. Deduction for charitable contributions.

Typically as long as the amount of the mortgage does not surpass 750000 the interest paid towards the mortgage qualifies as a deduction. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. 15 2017 have this lowered to the first 750000 of the mortgage.

Deduction for mortgage interest paid. This shortens their. Mortgage interest rates are always changing and there are a lot of factors that.

You can use the following calculators to compare 10 year mortgages side-by-side against 15-year 20-year and 30. Few homes are built to last 100 years. Calculate your mortgage payment.

To purchase 2 points this would cost 4000. Lower interest rates compared to 30-year terms.

How Much Of A House Do You Typically Own After 10 Years Of A Traditional Fixed 30 Year Mortgage Quora

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

1

Amortization Table Real Estate Exam

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Additional Mortgage Payment Savings Infographic Househunt Real Estate Blog Mortgage Payment Savings Infographic Mortgage Info

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Scotia Mortgage Rates Shop 57 Off Sportsregras Com

1

Chrome Extension Popups Design Inspiration Ux Planet Credit Https Uxplanet Org Chrome Extension Popups Design Chrome Extension Extension Designs Design

Will Rising Interest Rates Kill Atlanta S Hot Housing Market Atlanta Ga Patch

1

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Why Are Mortgage Rates Falling After The Fed Raised Interest Rates